Like every other sentient progressive, I’m enthused by the mayoral election results in New York City, my favorite place in the whole world. If only I could afford to live there. The fun is not quite over, however. There is still the general election in November, with a lot of hysterical money piling up to throw against Zohran Mamdani. And there could be the challenge of delivering as mayor of NYC, the hardest job in the world.

I had thought that Cuomo would run as a spoiler in November if Mamdani won the Democratic primary, since, like the scorpion, it’s in his nature. But the latest indications are that might not happen, which means we will get some other swine.

I’ve pointed out the contradiction between where most U.S. left activism is concentrated, the big cities of New York, Chicago, etc., and the fiscal disadvantages endured by those cities under unsympathetic state legislatures and the U.S. federal system. In New York City, the tax increases required to deliver on Mamdani’s agenda face the hurdle of the state legislature in Albany.

More generally, local taxes are the easiest to escape. The taxed entity can pick up and move without straying too far from its business needs. There is one big exception, however. That would be a land value tax, sometimes called a tax on site value, as opposed to “improvements.” The latter refers to any sort of construction on the land.

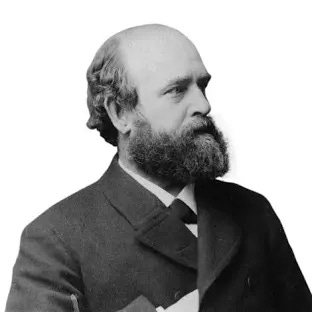

The LVT was proposed to great fanfare in the 19th Century by the economist Henry George, before most economists were assholes. He did not forego hyperbole, selling it as a “single tax” that would make all others (then mostly regressive excises and tariffs) unnecessary.

The beauty of an LVT is that the land can’t run away. A property tax hits both site value and improvements. The latter can be discouraged by taxation. The LVT is pretty much a straight expropriation from landowners to the public sector, and in NYC, only the rich own land. Such a tax could affect rents, but it could be restricted to commercial real estate. Construction of all sorts could proceed, especially on vacant land, which a LVT would penalize.

In Pennsylvania, some municipalities experimented with a “split-rate” property tax. The split referred to different rates on site value and improvements. There is no big deal about assessing site value. Governments have been doing it forever.

Decades ago, I was on a phone call with NYC activists. I tried to interest them in the LVT, with little success. They were more interested in a tax on financial transactions. There are many examples. My friend Dean Baker has been the go-to guy on that. It is a more delicate matter, since especially under contemporary circumstances, transactions could migrate to stock exchanges outside of the city. Here a more modest bite out of the apple would be required. Still, there would be a cost to moving exchanges that a tax could undercut.

Deano:

Tomorrow I will take a stab at Mayor Mamdani’s foreign policy.

Max, it’s good to see you are as perceptive and well-versed as ever. The Philadelphia Inquirer once published an article I wrote about Henry George. I still believe his work has yet to receive the coverage it deserves.

Yes Dino yes